The Royal Bank of Scotland swung back into the black in the first quarter – the first time since 2015 – but it is not as positive as it looks.

The bank is still being hit by litigation and restructuring costs and it was relieved to not have to pay a £1.2 billion to the Treasury, which it did a year ago in order to remove a block on dividend payments.

TheDAS system -Final Dividend Access Share payment to the Treasury – was created after the bank’s bailout in 2008, which means the government gets a payout of dividends before any other shareholder.

Operating profit before tax hit £713 million in the first quarter this year while net profit beat analyst expectations of £50 million, hitting £259 million.

RBS, which is 73% state-owned, said in its Q1 results statement that it was still encountering a number of costs.

These include:

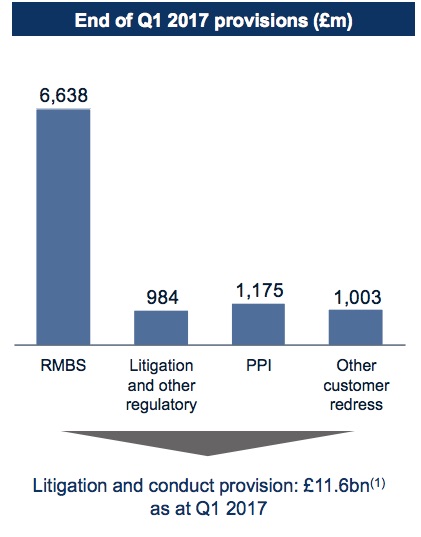

- Restructuring costs - £577 million in the quarter, an increase of £339 million compared with the same quarter last year. Litigation and conduct costs - money set aside for legal issues and compensation -£54 million "comprised a number of small charges."

"These results reflect very much what we talked about at full year. Firstly, a strong and improving core bank and secondly, fewer remaining legacy issues. Core income is up on last year, adjusted costs are down, and we're making better use of capital," said RBS CEO Ross McEwan.

"This bank has a very strong core with great potential, and we believe that by going further on cost reduction and faster on digital transformation - we will deliver a simpler, safer and even more customer-focused bank, with a compelling investment case."

RBS still has a lot of issues to tackle

Although the Q1 results do not look too bad in isolation, you have to look at the long-term trend.

The results come after RBS reported its ninth consecutive year of losses, in February, and said it would not make a profit until 2018.

The bank said in its full year financial results statement that it lost £6.955 billion compared with £1,979 million in 2015. The reason it lost so much money is down to litigation and conduct costs - money set aside for legal issues and compensation - of £5.868 billion, as well as other key elements, such as restructuring costs totalling restructuring costs.

Compare this to UK-listed bank Barclays and it is even more apparent how dwarfed it is by others in the market.

Barclays' pre-tax profit soared to £1.6 billion from £793 million. This is compared to RBS' pretax profit of £713 million, which was helped by the lack of a government payment.

It is also struggling to see what it can do about its spin-off Williams & Glyn unit, which it was initially meant to sell as a condition of its massive government bailout in 2008.

RBS has struggled to sell it's W&G unit for years. Initially, when RBS was bailed out by the UK taxpayer for £45 billion from 2008, one of the conditions was that RBS must sell W&G as a condition of returning excess capital and dividends to investors.

Last year, RBS warned that it would fail to meet the initial December 2017 sale deadline.

So the government put a "radical new plan" together that would allow the bank to provide £750 million in a series of initiatives,that is aiming at boosting "competition in today's UK business banking market," after RBS struggled to offload the small-business lender.

However, the EU is still assessing this plan and it could block it from happening.

Meanwhile, RBS last year set aside £3.1 billion for an impending fine from US authorities related to the mis-selling of toxic mortgage securities during the financial crisis. In its results it said it is not setting more cash aside. However, it could end up costing more. RBS even said last year that it will probably need to make further provisions.